In part 1 of this sharing, I mentioned that there are 2 crises happening concurrently now — one is coronavirus crisis, and two is economic crisis. The coronavirus was the pin that bursted the bubbles and triggered the unfolding economic crisis. It’s vital to understand that the COVID-19 coronavirus pandemic is not the root cause of what the economic crisis that the world will experience in the coming months and years, otherwise no critical lesson would be learned, just like 2008. In part 2, I will cover a few more critical parts of the puzzle on why we will likely be experiencing an unprecedented economic crisis of our lifetime and what can small-medium business owners and individuals do to prepare.

My interest to understand how the global financial system and economy truly works started after a personal lesson during the 2008 global financial crisis (GFC).

That painful lesson kickstarted my learning journey of past 11 years. I’m astonished that instead of valuable lessons learned, much of the global financial system has become even more reckless and fraudulent. In order to learn what I can do to prepare for the inevitable financial crisis that will likely be 10 times worse than 2008, I started to read from wide and diverse sources of information. I began to follow interviews and sharing from billionaires and multi-millionaires entrepreneurs and investors who foresaw 2008 and did well during the GFC. These include hedge funds managers Ray Dalio and Paul Tudor Jones, and investors Peter Schiff, Jim Rogers and Robert Kiyosaki. Jim Rogers has been saying for a few years that “the worst crash in our lifetime is coming”.

My attempt to piece together the puzzle, led me to become interested in a wide ranging subjects from currency, market, economic, geopolitics, politics, technologies and history. Besides those covered in Part 1, there are a few key developments since 2008 that needs highlighting to complete the picture.

The Rise of China…

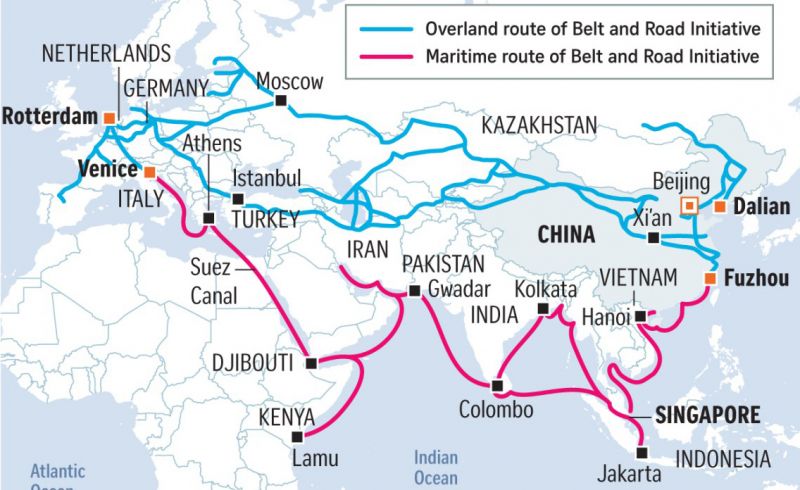

Over the past decade, China has experienced rapid progress that few could have foreseen. The west believed that China would for long remain essentially defined by imitation, unable to match the west’s capacity for innovation. But China has proven itself to have a formidably innovative economy. Shenzhen has come to rival Silicon Valley — while Huawei, Tencent and Alibaba can be counted in the same league as Microsoft, Google, Facebook and Amazon. China accounted for almost half of all patent filings in the world in 2018. China produced as many startup unicorns as the U.S. China is now the global leader in e-commerce, mobile payments and artificial intelligence (AI) technologies. Launched in 2013, China’s Belt and Road Initiative (BRI), also known as the New Silk Road, is an ambitious infrastructure project consisting vast collection of development, and investment initiatives would stretch from East Asia to Europe, significantly expanding China’s economic and political influence. China also initiated the setting up of Asian Infrastructure Investment Bank (AIIB), a multilateral development bank which states that its mission is to improve social and economic outcomes in Asia. AIIB rivals U.S controlled IMF and World Bank. China’s economy often grew more than 10% annually for the three decades before the 2008 recession. As of 2018, it’s growing at almost 7%, a more sustainable rate. China is today already the world’s largest economy by PPP adjusted GDP. The U.S. debt to China was $1.09 trillion as of February 2020. China has the second-greatest amount of U.S. debt held by a foreign country. China has been liberalising its control of the yuan, also known as renminbi (RMB). It has opened RMB trading centers in London and Frankfurt. It’s allowed the yuan to trade in a wider trading range around a basket of currencies that include the dollar.

China’s Belt and Road initiative ( source: Asia Green )

The rise of China threaten the dominating world’s leader position of the U.S. Harvard Professor Graham Allison published a book titled “Destined For War: Can America And China Escape Thucydides’s Trap?” in 2017. The insecurity engendered in the incumbent power at the prospect of being displaced by an emerging challenger could set them up for a conflict that neither might want. One perspective to view and understanding what’s going on between China and U.S. is that the two countries have been engaging in a “hybrid war” for some years now: trade war, technology war, currency war, cyber war and information war. U.S has a huge defence industry, roughly 10 percent of the $2.2 trillion in factory output in the U.S goes into the production of weapons. On January 17, 1961, in his farewell address, U.S. President Dwight Eisenhower warned against the establishment of a “military-industrial complex”, what he viewed as one of its greatest threats: the military-industrial complex composed of military contractors and lobbyists perpetuating war. We have since then seen his warning been ignored in the many U.S. led wars in Vietnam, Iraq, Afghanistan, Libya, and Syria. These wars and civil disorders were justified with U.S. CIA and National Endowment for Democracy (NED) sponsored media propaganda that they were for reasons of defending democracy vs communism, against terrorism and defending human rights. Lies are fabricated to benefit the defence industry, of which one of the biggest lie was that Iraq holds “weapons of mass destruction”.

On the other hand, the rising China doesn’t want to export its communist model, it can live with a diverse multi-polar world, a view articulated by many familiar with China, including Singaporean former diplomat, ex-president of UN Security Council, Professor Kishore Mahbubani. But China has a deep seated fear that China must not suffer a repeat of its “century of humiliation” from the mid 19th and 20th centuries, including the Opium War. China understands well the dangers of a weak government. It is unlikely that China will bow to the increasing threats from U.S. and we will likely see a decoupling of the two economies. The decoupling will impact businesses that depend on a globalised market, concurrently new opportunities might emerge to fill market gaps that arise from the decoupling.

Digital Technologies and Industry 4.0

The past decade, we have also experienced rapid improvements and adoption of several digital technologies that will have impact on the future of job and business. The growth in deployment of fibre optics, cloud computing, data centers, 4G, 5G infrastructure enabled the rapid adoption of various Internet-driven applications. For example, social media has disrupted the traditional media industry business model. Facebook became the world’s largest media company by crowdsourcing contents from its users rather than employing an army of journalists, editors, photographers, producers etc to create contents. Social media has also created new jobs like digital marketers, influencers, community manager, social media analyst etc. Social media is able to harness on its Big Data to enable companies and organisations to run marketing campaigns at target audience with detailed profiling.

Smartphones with its 2 millions of consumer and business apps, coupled with Internet of Things (IOT) devices, generated lots of Big Data daily that can be utilised to train machine learning algorithms. Artificial Intelligence (AI) and Robotics have made extensive advancement. Other emerging technologies such as Virtual Reality (VR), Augmented Reality (AR) and Blockchains are finding new applications.

Industry 4.0 refers to the growing use of these digital technologies in factories making it possible to collect and analyse data across machines, for machines to communicate with each other, enabling faster and more efficient processes to produce higher-quality goods at reduced costs. This manufacturing revolution will increase productivity, shift economics, foster industrial growth, and modify the profile of the workforce — ultimately changing the competitiveness of companies and regions. Germany is leading country in the smart factory race, with both China and U.S also racing to dominate in the global high-tech manufacturing.

Technology is a double-edged sword, while it brings increase in productivity, it has its unfavourable consequences. Leading AI expert, Kai-Fu Lee, said that he believes 50% of the world’s jobs, both blue collar and white collar professions, will be replaced by AI robots capable of automating tasks. It is not all doom and gloom. AI capabilities currently are still pretty much confined to what’s called Narrow AI: goal-oriented, designed to perform singular tasks like facial recognition, speech recognition/voice assistants, driving a car, or searching the internet, and is very intelligent at completing the specific task it is programmed to do. But Narrow AI doesn’t have the general intelligence that mimics human intelligence and/or behaviours, with the ability to learn and apply its intelligence to solve any problem, that will still be years away. We should embrace AI tools, using the tools to digest data efficiently to help us make better decisions and to use these tools to do parts of our jobs, especially repetitive routine tasks. Thus freeing time for us to focus on areas where humans have advantages such as jobs requiring empathy and creativity, for examples: elderly care, customer care, therapy, arts, management, as well as various roles involve in continuing to improve AI technology.

The New Normal

All the above mentioned developments have been evolving before the COVID-19 coronavirus crisis hit. The coronavirus crisis has accelerated the speed of the economic crisis hitting major economies worldwide.

Ray Dalio in his book “Principles for Navigating Big Debt Crises” detailed what governments can potentially do to achieve a “beautiful deleveraging” of the trillions of debts worldwide so that catastrophic adverse impacts could be minimised. Ray suggested that policy makers can utilise these 4 measures: 1) Austerity (i.e., spending less) 2) Debt defaults/restructurings 3) The central bank “printing money” and making purchases (or providing guarantees) 4) Transfers of money and credit from those who have more than they need to those who have less. His 480 pages book is based on detailed research of past financial crises and I highly recommend a read.

Some 81% in the global workforce of 3.3 billion are currently affected by full or partial workplace closures. International Labour Organisation saidthat the COVID-19 crisis is expected to wipe out 6.7 per cent of working hours globally in the second quarter of 2020 — equivalent to 195 million full-time workers. Unemployment will likely escalated beyond the second quarter, and we will see double digits unemployment rates being the norm for many countries.

With reduced or even zero income for majority of consumers and businesses, in order to raise cash, we could see people selling their assets: stocks, various financial products, real estates, luxury items, at discounted prices amidst a lack of buyers. We could see less demand for non-essential products/services and a whopping drop in demand for luxury goods and services. There might be potentially a short period of deflation. I foresee governments will be rolling out multiple trillions dollars of fiscal aids, and that Universal Basic Income or its equivalent will be a new norm in many countries. Massive currency printing to fund the fiscal aids, if not balanced carefully, risk creating hyperinflation in some countries.

Nobody knows with 100% certainty how both the crises will unfold and pan out. I’ve shared on some of the key developments since 2008 to put things in perspective and enable one to make an analytical prediction of the New Norm that might emerge and prepare for it.

Staying positive is important — we know that no storm lasts forever. We will prevail at the end, that’s for sure. But it’s equally important to be realistic — to confront the brutal facts of our reality. Our reality is that the consequences of this coronavirus pandemic could last much longer than many people are choosing to believe. Even when the coronavirus is contained within a country and lockdown is lifted, at some point of time, borders will need to be reopen and 2nd wave of spread might occurs. This will be a long fight, be prepared mentally for a marathon.

Once lockdowns are lifted, when will you feel comfortable to take your first flight, whether for business or leisure? When would you feel comfortable to bring your family to a movie in the cinema? How will you react when someone next to you starts to cough? The opening of the economy is likely to be gradual. Social distancing measures likely to continue for months.

The likelihood of V-shaped recovery is low. I believe that there is more than 60% possibility that we would experience of a prolonged global recession. Whether it will be a global depression, we will need to observe how the governments of the world’s major economies respond to the crisis to gauge.

A new normal for many industries will emerge. Take as an example: with wide adoption of work from home and people getting use to video conferencing, during this COVID-19 period, we might see significantly less commuting for work, international travel, large physical meetings and conferences. Travel, tourism, and events industries, which include airlines, transports, hotels, venues and related service providers and suppliers, will need to adapt to an emerging new normal.

In countries under lockdowns, only those working in essential services could continue going to work. An interesting observation is that many of the workers in essential services are not employed in the highest paid jobs, it just show how imbalanced a system we had for decades. Coronavirus shutdowns have unintended climate benefits: cleaner air, clearer water. The crisis offers an opportunity to restructure the system for a better world — productivity driven economic growth, closing the income gap and innovating towards a more environmentally sustainable global economy.

I’m of the view that it’s not that capitalism is the cause of all the mentioned problems but because more so that the past 50 years have been one of ‘shareholder capitalism’. Pro-market economist Milton Friedman advocated the core idea that companies should — within the framework of the law and regulatory systems — focus on returns for their shareholders. This focus on profit rather than broader social well-being was not supposed to be about selfishness or greed. The idea was that by doing what they do best, companies would maximise wealth creation and benefit wider society. But human greed is way underestimated, and things had gone very wrong.

Investor Paul Tudor Jones and founder of the World Economic Forum, Klaus Schwab, see a new model of stakeholder capitalism as the best alternative to the shareholder-focused one. Stakeholder capitalism is a system in which corporations are oriented to serve the interests of all their stakeholders. Among the key stakeholders are customers, suppliers, employees, shareholders, local communities, and I would add, the environment. Under this system, a company’s purpose is to create long-term value and not to maximise profits and enhance shareholder value at the cost of other stakeholder groups. I hope that we can reset the system and move towards stakeholders capitalism or similar equivalent in the new normal, and whereby economic growth is at a sustainable rate for the environment.

Another key new development is the collapse in oil prices. The pandemic has caused oil demand to drop so rapidly that the world is running out of room to store the barrels. At the same time, Russia and Saudi Arabia entered into a price war and flooded the world with excess supply. Hundreds of US oil companies could go bankrupt. Oil futures contracts dived into negative price on 20th April. Will we see the end of the petrodollar?

As we enter the post-lockdowns period, we will likely see China leading the recovery in economic activities. Looking at pace of businesses recovering in China will give a good few months ahead indication of pace of recovery for rest of the world.

What can Small-Medium Businesses do to Prepare?

Firstly, for owners of small-medium enterprises (SMEs), cash flow is really king. With the social distancing measures and lockdowns, many SMEs have experienced revenue drop of more than 50% to 100% for some, while they continue to incur many operational costs such as rental and employees’ salaries, and losses from perishable supplies. They may also face delays in payments from their clients for completed services or delivered products, putting further squeeze on cash flow. Some small business owners are taking personal loans and maximising out their credit cards. Many governments are supporting banks to offer working capital to SMEs.

As a SME owner, one need to objectively assess if one’s business was already struggling pre-COVID-19 crisis, and if its business model is still relevant in the emerging new norm. If the business is no longer able to address relevant market needs, not able to operate profitably, has little core competencies that can be capitalise on for diversifying into new markets and if to transform the business require hefty new capital injection, then the SME owner needs to seriously think twice about taking on more debts especially personal guarantee loans.

The coronavirus crisis has accelerated the adoption of digital technologies and growth of the Digital Economy. To survive and grow in the digital economy, where technology driven disruptions are common, there is no other way but to re-invent. The only sustainable advantages one can have are being agile and innovative. No more an era whereby one can rest on a “success formula” to sustain a business for 20–30 years. SMEs will need to be able to innovate on new products, services or/and business models. Design Thinking, Agile Scrum and Lean Startup are a few innovation methodologies that I’ve been a practitioner for many years, and which I share with and coach my students as well as my consulting clients on.

Regardless of which industries your business operates in, it will be inevitable to embrace use of digital technologies and digital transformation. Digital transformation goes beyond just the adoption of digital technologies, it is the transformation of a company’s competencies, priorities, processes, products, services and business models to fully leverage the opportunities brought about by digital technologies, the fast growing digital economy and the new normal.

The lockdown situations in many countries drive substantial uptake of e-commerce and conversion of various traditional face-to-face services to virtual online delivery, such as classes and non-emergency medical consultation. Event organisers and performing artists income were affected by social distancing measures. The One World: Together At Home online event on 18 April is an example of innovation in response to the new normal, the whole concert was streamed live to a global audience, attracted 21 millions viewers, and raised $127 millions for COVID-19 Solidarity Response Fund for WHO.

Airbnb was hatched in the midst of 2008 GFC and startup (then) Spotifysurvived and grew through the 2008 GFC. Both companies have internalised culture of operating agile and lean, embracing users experimentation and market data-driven decision making to steer innovations.

Traditional SMEs may not be able to attract tech talents to join as employees to support their transformation. What these SMEs can considered is to collaborate with technology companies and partnership with tech startups. Many tech startups lack in-depth understanding of market needs and pain-points and also lack the marketing channels for their products/services, gaps which established SMEs are able to fill. A mutually beneficial collaborative partnership will help both SME and startup to expand.

In places such as Singapore, there are also various government grants and schemes to encourage SMEs to go digital, embrace digital transformation, and to innovate. Funding are available to support adoption of various digital solutions, from POS, CRM, e-commerce, e-payment to data analytics solutions. Funding from government agencies and private incubators programmes are available to engage consultants and support new product development for innovative products/services.

A piece-meal approach in digital transformation for SMEs would not deliver the desired transformational results. When all levels of a company’s leaders and employees recognise the urgent need to transform in order to survive, only then will it takes proactive steps to implement digital transformation throughout the company.

Small-medium businesses will need to:

- consider what will be their business strategy to address the new normal and how digital transformation will fit into their plans;

- be able leverage new digital technologies such as data analytics, big data, artificial intelligence (AI), Internet-of-things (IOT), and robotics to keep operations lean and efficient, and to enable data-driven business decision-making; for examples: explore ways that e-commerce marketplaces like Amazon, Alibaba, AliExpress, JD, Etsy, Zazzle etc to expand internationally; and capitalise on big data of social media platforms like Facebook, Instagram and WeChat to build branding and generate customer leads;

- build a learning organisation that’s constantly upgrading knowledge and skills so that it can stays current with market demands, harness power of new technologies and methodologies, attract talents and become industry leaders;

- build a culture of innovation, listening closely to and empathise with customers’ needs, constantly experimenting and driving new innovations in business models, products and services; and

- adopt a lean, agile management approach that is nimble and able to seize emerging opportunities with fast decision-making.

With China and U.S. likely to continue to decouple, American companies will be looking to relocate manufacturing either back to U.S or to elsewhere in Asia. Chinese companies will be looking for new markets to fill the gap left behind by the U.S market. SMEs could explore opportunities to be bridge for Chinese or American companies to their countries or region. The pandemic crisis exposed the weakness of long global supply chains. Countries will be investing in achieving certain levels of self-sufficiency, and this trend might open out opportunities for SMEs.

What can Individuals do to Prepare?

Given the magnitude of the crises, the coming months and years will have many unknown risks. With the massive printing of currencies, the risk of currency depreciation is increasing and if one’s government overdo the printing, hyperinflation risk is high. One of priorities for individuals now is the need to find ways to “insure” against these risks.

A form of “wealth insurance” is physical gold, which has been used as money for thousands of years and survived multiple paper currency collapses since the first paper currency aka promissory notes was used in China around 118 BC. Ray Dalio said it best back in 2015: “If you don’t own gold, you know neither history nor economics.”. A few seasoned investors have advocated 5–10% of your portfolio should be in physical gold. Note also that many central banks continue to hold significant amount of physical gold and some such as Russia and China been accumulating more since 2008.

Individuals should carefully review one’s assets and debts situation. Are any of the assets , especially financial derivative products, at risk of significant loss in values? Will any of the bonds default? Will any of the companies, whose stocks you own, be badly affected by both crises, will their businesses continue to perform in the new normal? Will these companies be at risk of bankruptcy? Remember that Moody and S&P maintained positive investment grade A2 and A credit ratings respectively for Lehman Brothers till just days before its collapse. Both Fannie Mae and Freddie Mac had highly coveted AAA ratings at the time they were forced into conservatorship. Do you understand clearly the risks associated with the financial structured investment products you hold? S&P gave American International Group (AIG) an investment-grade A rating less than a week before the insurance company was nationalised. So yes, review even your life insurance policies.

Bearing in mind the high probability of earning less income in coming months and years, can one continue to service one’s debts, whether they are mortgage or other personal loans? Examine how to re-balance your investment portfolio to diversify across asset classes, industries, and geography to minimise the potential risks in the event of a prolonged recession.

As the global economy goes into a recession, there will be less jobs and business opportunities. One needs to recalibrate future income and lifestyle expectations. It will likely be a prolonged recession, so the usual 6 months buffer might not be sufficient. Differentiate what are truly essentials to have and re-prioritise how your income and savings are to be spend. Adjusting one’s lifestyle is a key step.

In today’s volatile and fast changing environment for both business and jobs, one can’t expects that what one learned in schools a couple decades back are sufficient to serve one’s life-long career. I think that college diplomas and degrees should come with “expiry dates”. Whether it’s the way to do product development, sales, marketing or managing teams or run a business, the skill set required have evolved and one needs to keep up. Become a lifelong learner, be curious, be motivated to re-skill, to learn and develop new skills for new jobs that are in-demand. Lifelong learning can enhance our understanding of the world around us and provide us with more opportunities.

The coronavirus had awaken many to the fact that health is the top priority. Not just physical health, mental health is equally important. The pandemic and lockdowns have already resulted in more people experiencing anxiety. Taking care of one’s mental health is needed in order to weather the prolonged period of stress from loss of income, multiple job application rejections, business failure and uncertainty of the future. Regular exercise, healthy diet, and adequate sleep are crucial.

Photo by Nathalie Désirée Mottet on Unsplash

Research has found that mindfulness practice and meditation can help reduce stress and anxiety. Focus on things that are within your control and gratitude for what you do have. Reach out and help those more vulnerable and less fortunate in your community.

“The best antidote I know for worry is work. The best cure for weariness is the challenge of helping someone who is even more tired. One of the great ironies of life is this: He or she who serves almost always benefits more than he or she who is served.” quote from Gordon B. Hinckley.

Spiritual development can help us deal with life’s challenges and grow into a better, more whole and happy person.

Conclusion…

In summary, the coronavirus pin has burst the financial bubbles and an economic crisis of a scale unprecedented in most people’s lifetime is unfolding. The root causes for the economic crisis can be traced back to a few decades of loose monetary and fiscal policies especially by the U.S. Fed and government who holds special status of world’s reserve currency. Rampant greed and fraudulent activities in the financial sector that resulted in the 2008 GFC didn’t get fixed, instead the recklessness has multiplied over the past 11 years. Total global debt has snowballed to an estimate $257 trillion at end of March 2020. The gap between rich and poor has grown too wide, and most people have not seen real income growth in decades. The economy is stacked against those at the bottom. The system is broken, a reset will be inevitable at some point of time. That time of reckoning might be coming very soon.

Being agile, lean and prioritising innovation are imperative. As each SME’s and individual’s situation is different, it wouldn’t be possible to cover recommendations for everyone here. Ray Dalio, one of the world’s most successful investors and entrepreneurs, shares the unconventional principles that helped him create unique results in life and business — and which any person or organization can adopt to better achieve their goals. I would recommend you follow Principles by Ray Dalio in this link.

Remember: we will prevail at the end, that’s for sure. Stays safe, stays healthy.

Khengwah Koh

This blog was first published on Medium on 27 April 2020 .

Khengwah Koh is the Founder and Principal Consultant of Askvisor, a boutique management consulting firm that supports clients in digital transformation, design thinking, new products/services/business models innovation, digital branding and marketing.