Digital Transformation – Part 1: Disrupt or Be Disrupted

By Khengwah Koh, Askvisor Consulting

New business models enabled by digital technologies have disrupted many businesses, regardless of their sizes, from the small brick and mortar retail store to large multi-national corporations.

According to Innosight: “The 33-year average tenure of companies on the S&P 500 in 1964 narrowed to 24 years by 2016 and is forecast to shrink to just 12 years by 2027.”

52% of the Fortune 500 firms since 2000 have been merged, acquired or bankrupted. These include once well-known brandnames and industry leaders like Eastman Kodak, Compaq, MCI Worldcom, Xerox, Time Warner, and Toys 'R' Us.

There is no more “business as usual”

Change is the only Constant. No industry is immune. Companies that fails to embrace digital transformation will likely see their business being disrupted. For centuries, middlemen such as distributors, agents, brokers, played the roles of connecting sellers of products or services to buyers and support the collection of payments. In some industries, the profits that these intermediaries made, may exceed even those of suppliers of the products or services. One of the reasons that middlemen had been able to command a fat channel margin was that they filled the information gaps that exist between sellers and buyers. Internet-enabled technologies made information transparent and put many of these intermediaries out of business. In the recent decade, from manufacturers, cottage industry to stock brokers to insurance agents to bankers, the middlemen that offer little value-added are disappearing.

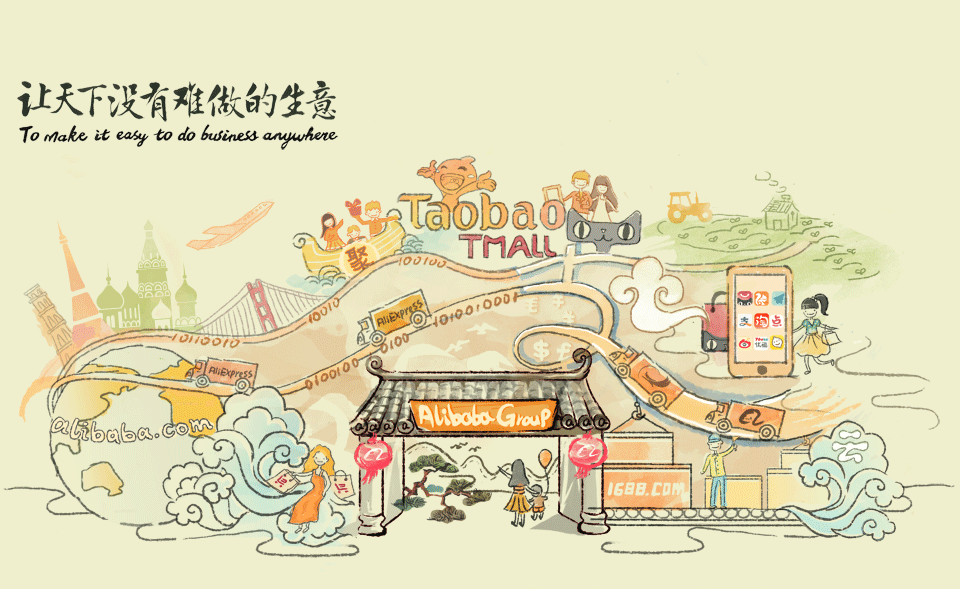

Take the example of Alibaba Group, founded in 1999 by a team of 18 led by Jack Ma, a former English teacher from Hangzhou China. Today, Alibaba Group connects millions of merchants and brands to more than 440 millions buyers on its group of e-commerce platforms which include Alibaba, AliExpress, Taobao, and TMALL. Alibaba uses the Internet to level the playing field by enabling small enterprises to leverage innovation and technology to grow and compete more effectively in the domestic and global economies. Through crowdsourced ratings and reviews of products by buyers on the e-commerce platforms, buyers are able to filter out merchants that supply poor quality products. The transparency removed one of the key roles played by traditional middlemen.

There is no more business as usual for the middlemen. They have to either evolve or become obsolete. The new "digital middlemen" will need to value add, for examples, by mastering how to use digital marketing to effectively target buyers, and to use data analytics tools to find out details of what buyers want.

New technologies like warehouse robotics, fleet management software, crowdsource last-mile delivery solutions, have transformed supply chain management and open out new possibilities to serve consumers in ways that were previously not economical. Consumers' lifestyles have been transformed. They can order all kinds of stuff online, from consumer electronics, household goods, grocery to movies stream directly into their homes without them having to take a single step out of their homes.

Startup Meituan Dianping is able to capitalise on this trend and has garnered 280 million annual active users and works with 5 million merchants in China. With a few taps on its smartphone apps, Chinese consumers can order hot meals, groceries, massages, haircuts and even manicures at home or in the office. One of their popular service offers the ability to have your car that is parked on the street washed while you're at work, and the service provider sends a photo to your phone to verify the job.

Video and music streaming services, made available by high speed Internet, have created companies like Netflix and Spotify, that have totally disrupted the business of once Fortune 500 listed Blockbuster and also killed off the countless record retail stores.

One of the biggest casualties of this digital economy trend are the brick and mortar retail stores. In United States alone, an estimate 8,600 stores closed in 2017, including brand-name stores of Sears, Macy’s, JCPenney and Kmart. Similar trends can be witnessed across Europe and Asia.

In part 2 of this #DigitalTransformation series, I will share on new digital economy business models that have disrupted and transform various industries and what companies can learn from those who have successfully hyper-grow their businesses in this new digital economy.